Besides being an additional retirement pot the PRS is also income tax deductible. Earnings generated by the PRS funds will also be exempted from tax charges.

Cover Story Budget 2020 Top Tax Bracket Raised To 30 Tin Number Proposed The Edge Markets

Published by PricewaterhouseCoopers Taxation Services Sdn Bhd 464731-M Level 10 1 Sentral Jalan Rakyat Kuala Lumpur Sentral PO.

. Published by PricewaterhouseCoopers Taxation Services Sdn Bhd 464731-M Level 10 1 Sentral Jalan Rakyat Kuala Lumpur Sentral PO. Publicly listed on the Main Board of Bursa Malaysia Apex Healthcare Berhad is an investment holding company with four key business groups. Losses may be carried forward for seven consecutive.

The Service Tax rate is fixed at 6. Therefore there is neither an exchange gain nor loss for ABC Sdn Bhd. Robotics Accounting Firm.

Founded in 1962 our core expertise is in the. We are proud to announce that Kuala Lumpur Kepong Berhad has been selected as a recipient for CSR Malaysias Sustainability CSR Malaysia Awards 2021 Company of the Year Award for Leadership in Community Education Scholarship Welfare. In accordance with Section 2 of Service Tax Act 2018 imported taxable service means any taxable service acquired by any person in Malaysia from any person who is outside Malaysia.

Xepasp Apex Pharma International and Corporate. Locate GDEX Drop by at any of the nearest GDEX branch lodge-in center OR visit our Reseller Agents Outlets at your convenience. With effective from 1 January 2019 imported taxable service is subjected to service tax.

To open a corporate account with GD Express please click here or kindly contact our Sales Desk at 03-64195003 or email. This however was reversed in September 2018 when the GST which the public blamed for rising cost of living and the Pakatan Harapan PH coalition pledged to abolish if it came to power was repealed after PH took control of Putrajaya following the. A specific rate of tax of RM25 is imposed upon issuance of principal or.

Filing of Return and Tax Payment SST Registrant. Income tax rate on a resident individual is on a progressive basis where the rate is 0 on chargeable income not exceeding RM 5000 and 30 on chargeable income exceeding RM 2 million. Box 10192 50706 Kuala Lumpur Malaysia Tel.

Box 10192 50706 Kuala Lumpur Malaysia Tel. Apex Healthcare Berhad is a leading regional pharmaceutical group with operations in Singapore Malaysia Vietnam and Indonesia. 603 7890 4700 General Line.

Public Bank a complete one-stop financial portal offering a range of accounts credit cards loans deposits and other financial aids for our personal and commercial customers. You will be able to deduct up to RM3000 from your taxable income which will count towards your final tax payable. Up to 31598 individuals and entities have failed to disclose their actual income with the IRB.

Call for Pick-Up Contact our Pick-Up Hotline at 03-64195003 and we will pick-up your parcels at your doorstep. Malaysia replaced the SST tax regime with the GST on April 1 2015 with a 6 tax rate. 1562019 but if the exchange rate on 1562019 was RM420 USD1 again the RM equivalent for UDS10000 was RM42000.

According to the IRB this data is based on information through the ownership of assets and the ability of. Registrar Helpdesk. Switch to 3E Accounting Services Sdn.

Services imported by Malaysian businesses from 1 January 2019 while services imported by Malaysian consumers from 1 January 2020. A non-resident individual will be subject to tax at 30 on his income. Being taxed at the 24 rate.

THE Inland Revenue Board IRB gives one month period from today June 15 until July 15 this year for 31598 individuals and business entities to report their actual income. PRS Income Tax Relief. Taxability and Deductibility of Foreign Currency Exchange Gains and Losses In order to determine whether a business entity is subject to tax on its foreign.

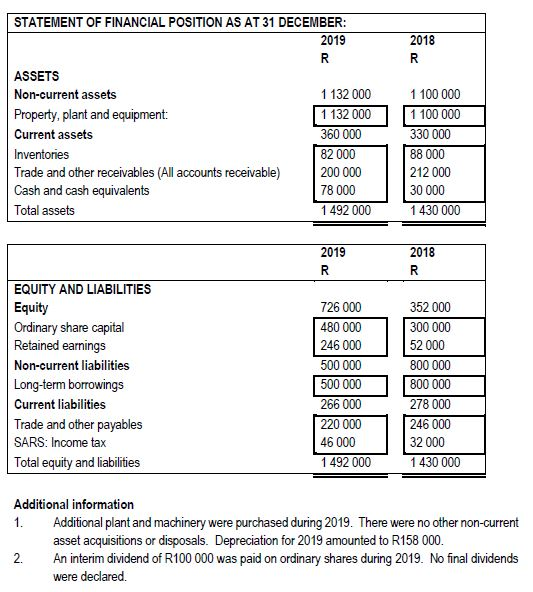

Solved Question 3 20 Marks Required 3 1 Use The Chegg Com

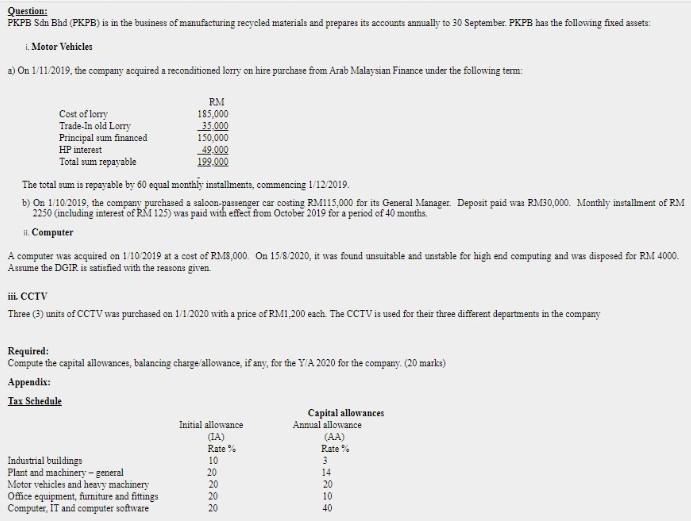

Question Pkpb Sdn Bhd Pkpb Is In The Business Of Chegg Com

Solved John And Sandy Ferguson Got Married Eight Years Ago And Have A Course Hero

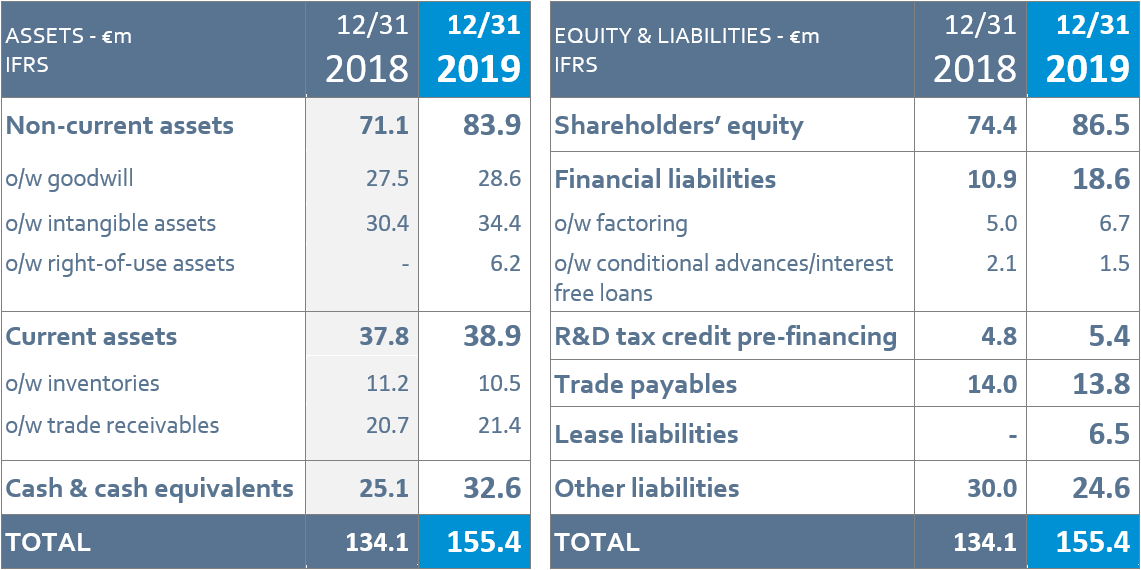

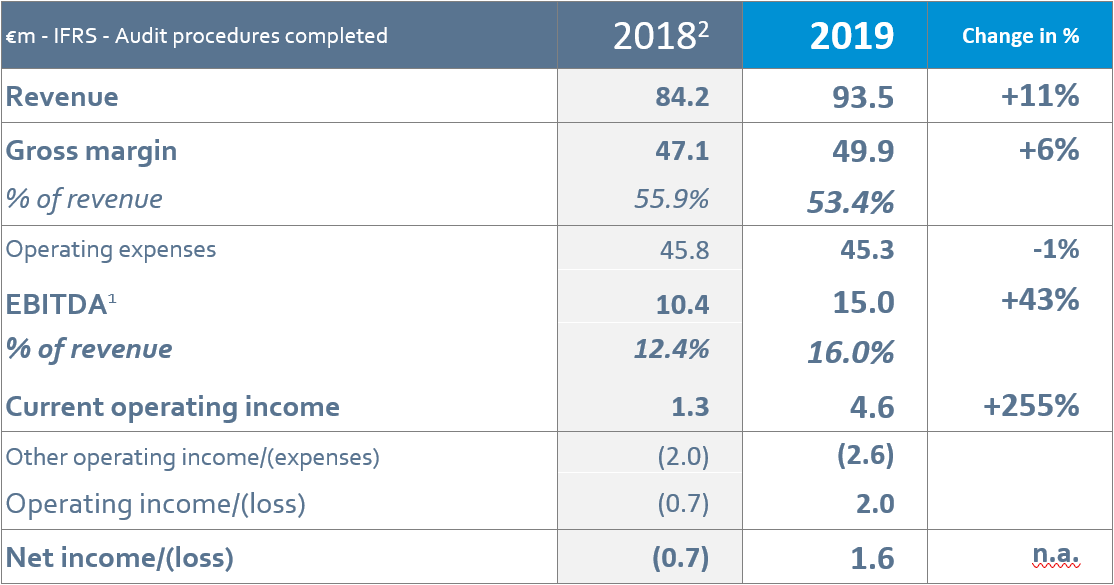

2019 Annual Results Revenue 11 Ebitda 43 Record Ebitda Margin Of 16 0

Malaysia Solar Energy Profile A Global Solar Manufacturing Hub Malaysia Cautiously Steps Up Efforts To Boost Growth Liberalize Domestic Market

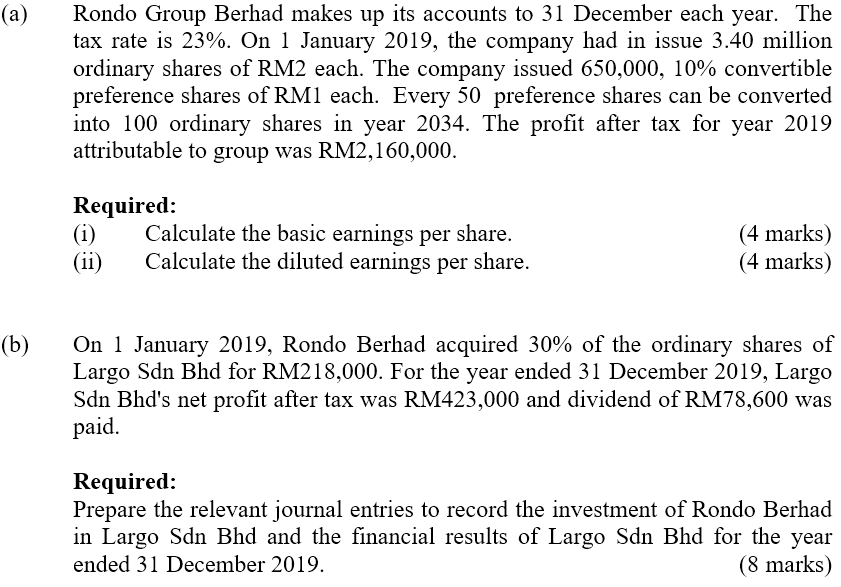

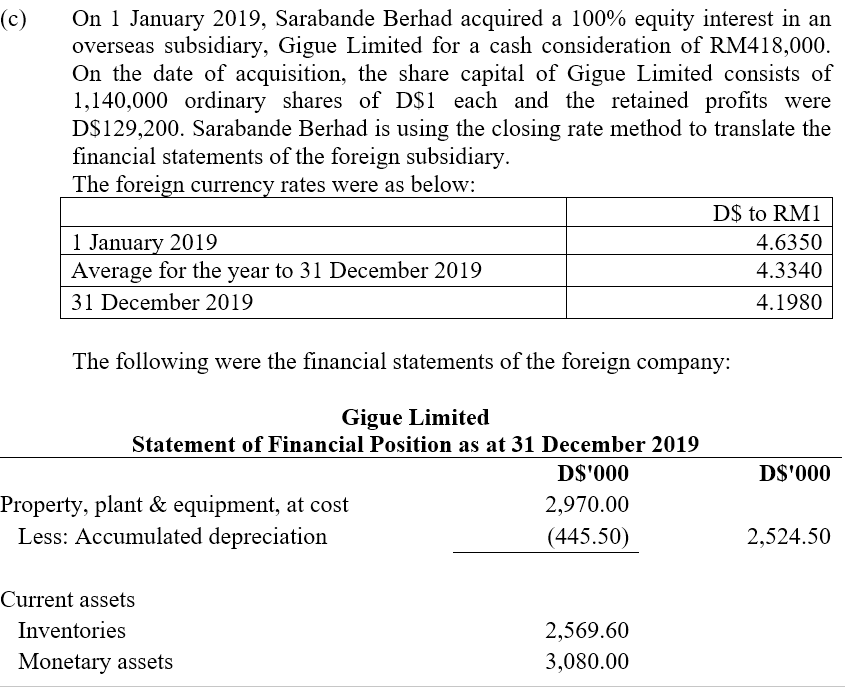

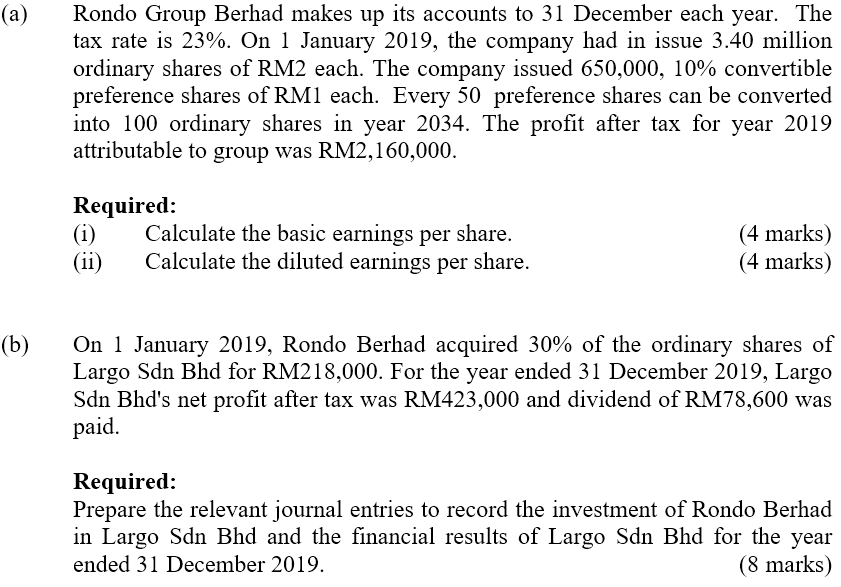

Solved A Rondo Group Berhad Makes Up Its Accounts To 31 Chegg Com

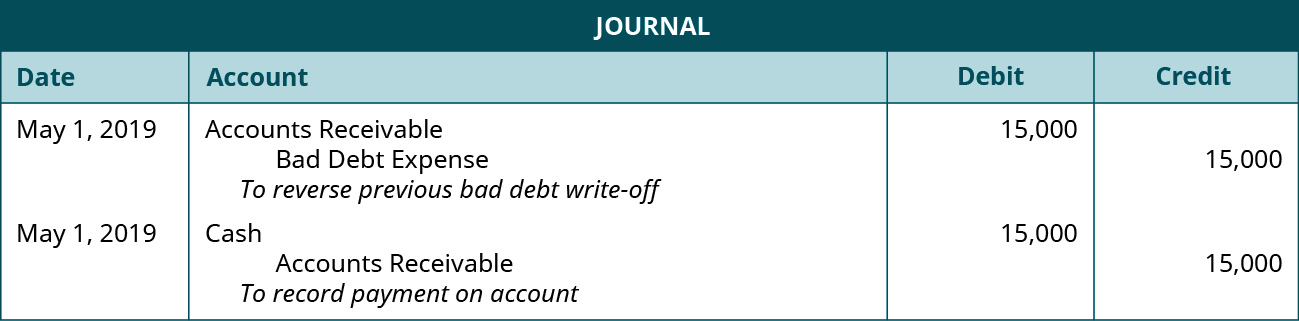

Account For Uncollectible Accounts Using The Balance Sheet And Income Statement Approaches Principles Of Accounting Volume 1 Financial Accounting

Malaysia Maxis Bhd S Total Revenue 2021 Statista

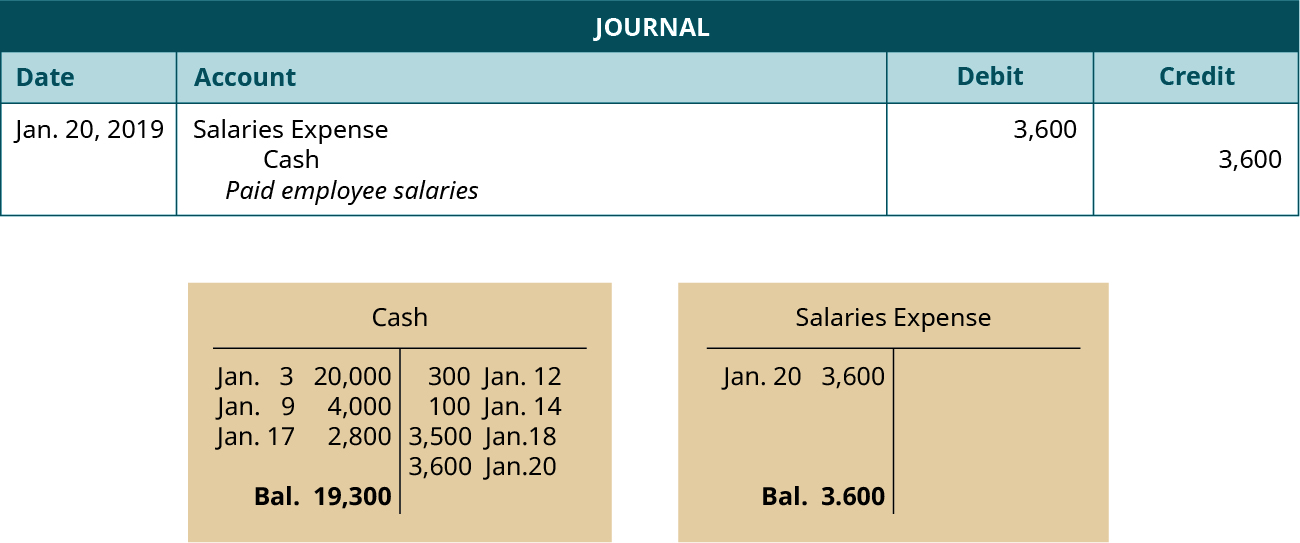

Use Journal Entries To Record Transactions And Post To T Accounts Principles Of Accounting Volume 1 Financial Accounting

Occupational Safety And Health Disaster Prevention Sustainability Dic Corporation

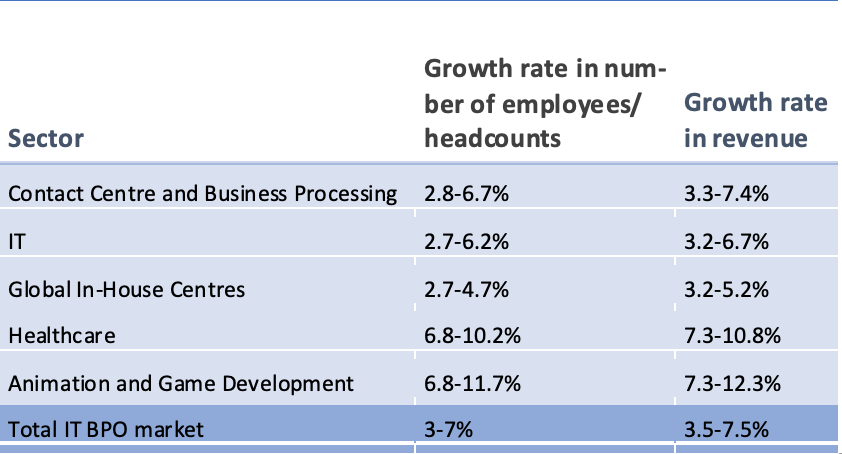

Covid 19 And The Philippines Outsourcing Industry Lse Southeast Asia Blog

Solved A Rondo Group Berhad Makes Up Its Accounts To 31 Chegg Com

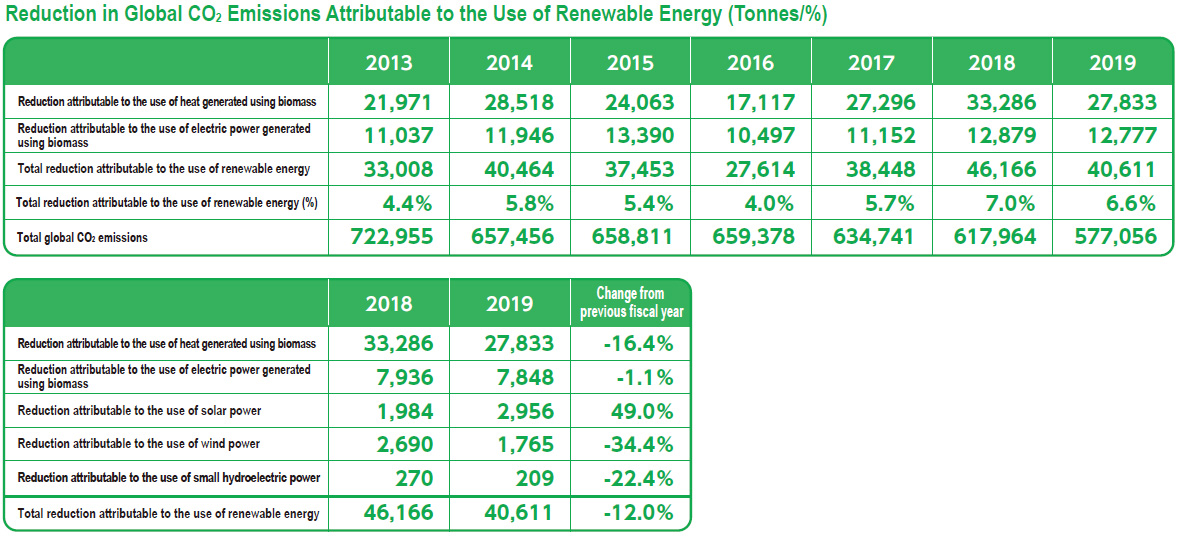

Preventing Global Warming 2019 Sustainability Dic Corporation

2019 Annual Results Revenue 11 Ebitda 43 Record Ebitda Margin Of 16 0

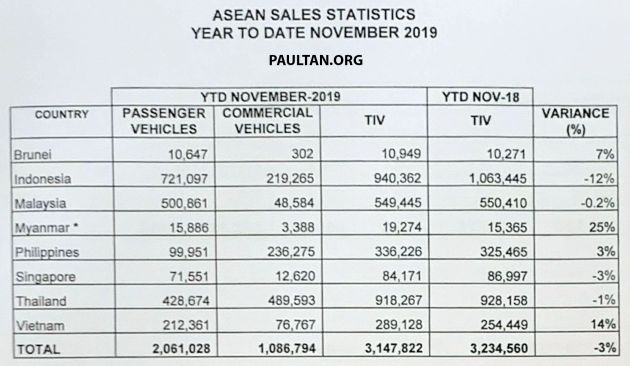

Malaysian 2019 Vehicle Sales Performance Compared To Other Asean Countries Indonesia Remains Top Paultan Org

Solved Question 3 20 Marks Required 3 1 Use The Chegg Com

Use Journal Entries To Record Transactions And Post To T Accounts Principles Of Accounting Volume 1 Financial Accounting

Tax Implications Of Financial Arrangements For Motor Vehicles Acca Global